Health sector underrepresented on Nigerian Stock Exchange

Lagos, Nigeria – The Nigerian healthcare sector, a critical driver of national development, remains strikingly underrepresented on the Nigerian Stock Exchange (NGX), despite increasing demand for medical services, rising health technology adoption, and the growing need for financing to address Nigeria’s healthcare gaps.

Industry experts say the limited presence of healthcare companies on the NGX underscores broader challenges in the sector, including inadequate investment, regulatory hurdles, and a high reliance on donor funding and out-of-pocket payments.

A Neglected but Critical Sector

Nigeria is Africa’s most populous country, with over 220 million people. However, healthcare spending remains low, accounting for less than 4% of GDP, according to the World Bank. The private sector delivers more than 60% of healthcare services, yet only a handful of health-related companies are publicly listed on the NGX.

Unlike the banking, oil and gas, and telecom sectors—where multiple firms trade publicly—the healthcare industry has failed to establish a strong footprint. This lack of representation limits both transparency and the ability of healthcare providers to access large-scale funding through equity markets.

Why Healthcare Companies Avoid the Stock Market

Several reasons explain the reluctance of Nigerian healthcare firms to list on the NGX:

-

Regulatory complexity: Pharmaceutical and healthcare firms face stringent approvals from multiple agencies such as NAFDAC and the Pharmacists Council of Nigeria, in addition to NGX listing requirements.

-

Fragmented industry: Many hospitals, pharmacies, and diagnostics centers are small to medium-sized businesses, often family-owned, without the scale or governance structures required for public listing.

-

Investor perception: Healthcare companies are often viewed as high-risk due to unpredictable revenues, dependence on donor programs, and pricing pressures.

-

Limited government incentives: Unlike other strategic sectors, there are few targeted tax breaks or incentives to encourage public listing by healthcare firms.

Untapped Opportunities for Growth

Despite these barriers, experts argue that the Nigerian Stock Exchange could serve as a game-changer for the healthcare sector. With increased listing of hospitals, pharmaceutical firms, biotech startups, and digital health companies, the sector could unlock much-needed financing to expand services and infrastructure.

“There is huge potential for healthcare companies to raise capital on the NGX, especially in diagnostics, pharmaceuticals, and health tech,” says Dr. Chinyere Okonkwo, a Lagos-based healthcare economist. “Nigeria has the market size, the patient demand, and now investor interest in digital health and medical technology. The missing link is creating an enabling environment for these firms to thrive on the exchange.”

Rising Investor Interest in Health Tech

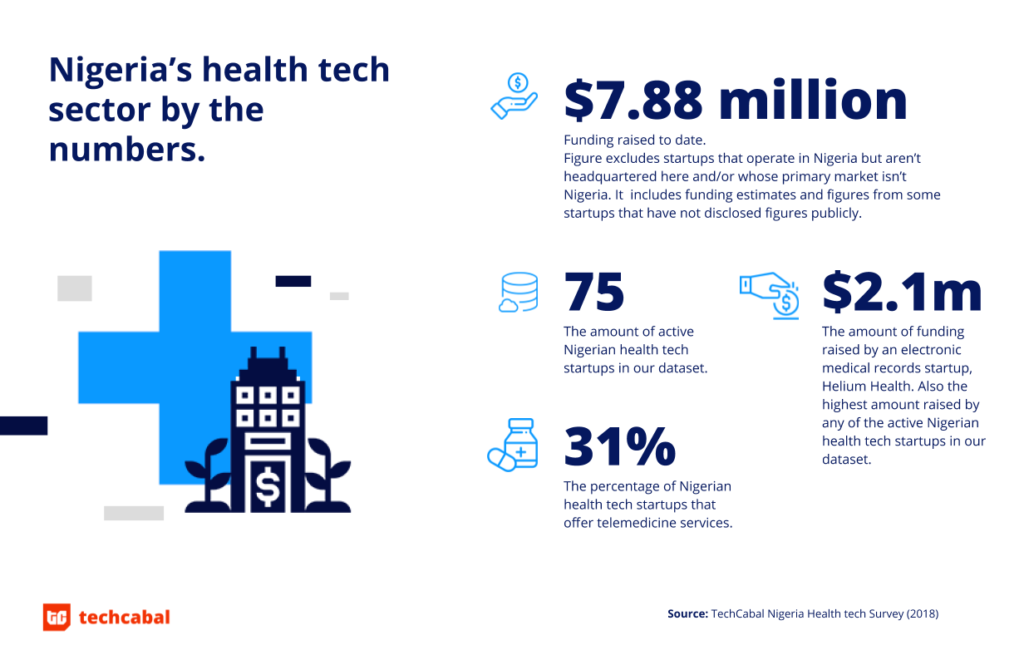

Globally, health technology has emerged as one of the most attractive investment sectors, and Nigeria is no exception. In recent years, health tech startups like Helium Health, 54gene, and HubPharm Africa have raised millions in funding from international investors.

However, most of these deals occur through venture capital and private equity, not through the NGX. If more Nigerian health tech firms went public, local investors—including pension funds and retail investors—would gain opportunities to participate in the sector’s growth.

Policy Shifts Could Spur Listings

Stakeholders suggest several measures to encourage healthcare firms to list on the NGX:

-

Regulatory harmonization: Streamline healthcare and capital market regulations to make listing easier.

-

Incentives: Provide tax holidays, grants, or lower listing fees for healthcare companies.

-

Investor education: Raise awareness about healthcare as a profitable long-term investment sector.

-

Corporate governance support: Help medium-sized healthcare firms build the structures required for public listing.

If implemented, these reforms could attract more healthcare players to the stock exchange, boosting not only the sector but also Nigeria’s overall economic growth.

Why It Matters

Nigeria spends billions annually on medical tourism, with citizens traveling abroad for treatment due to limited facilities at home. A stronger healthcare sector, supported by capital markets, could reduce this outflow, create jobs, and improve health outcomes.

“The underrepresentation of healthcare on the NGX is a missed opportunity,” says market analyst Sola Adedoyin. “We need more hospitals, pharmaceutical companies, and biotech firms listed to drive investment and innovation.”

Conclusion

The Nigerian healthcare sector is at a crossroads. On one hand, it faces challenges of poor funding, weak infrastructure, and a lack of representation on the Nigerian Stock Exchange. On the other, it sits on massive opportunities in pharmaceuticals, biotechnology, and health technology.

For Nigeria to achieve Universal Health Coverage (UHC) and strengthen its healthcare system, capital markets must play a more central role. Encouraging more healthcare companies to list on the NGX will not only deepen the market but also provide the funding necessary to transform Nigeria’s healthcare landscape.