Nigerian Healthtech Ventures Garner Investor Interest as Funding Soars

A remarkable upsurge in funding for healthcare-focused technology companies in Nigeria and Africa is unfolding, driven by investors keen on diversifying their portfolios and channeling substantial investments into this sector.

A recent report by Briter Bridges, a platform specializing in tracking investments across the tech ecosystem, unveils an impressive statistic: healthcare startups have managed to secure a staggering $330 million across more than 30 deals during the initial half of 2023. This marks a momentous leap from the mere $40 million recorded in the latter half of 2023 and the $125 million reported in the first half of 2022.

This dynamic shift garners attention from experts, who underline the sector’s burgeoning momentum. Historically, healthtech enterprises have often stood in the shadow of fintech counterparts when it comes to investor allure. However, the tide has turned, with the health sector outpacing other segments in terms of percentage growth over the span of three quarters. Investors are seemingly awakening to the pressing needs of this sector, yearning to infuse much-needed capital into its core to combat entrenched challenges.

A vital driving force behind this surge is the World Health Organization’s (WHO) revelation that a staggering 72 million Africans, constituting 48 percent of the continent’s populace, grapple with limited access to quality healthcare services. This gap acts as a poignant catalyst propelling investors toward initiatives seeking to bridge the divide.

Against the backdrop of Nigeria’s healthcare landscape, beset by dilapidated infrastructure and a dearth of modern medical facilities, this swell of investment holds paramount importance. Remarkably, Nigeria stands as one of the world’s fastest-growing populations, with a rate of 5.5 live births per woman and an annual population growth of 3.2 percent. By 2050, the nation’s population is projected to burgeon to 400 million, making it the globe’s third most populous country.

Alas, the supply of medical professionals pales in comparison to this vast demand. WHO figures reveal a glaring disparity, with only approximately 35,000 doctors available, a mere fraction of the requisite 237,000. This shortage is partially fueled by the massive exodus of healthcare workers seeking opportunities abroad. Consequentially, Nigeria grapples with a staggering annual loss of at least $2 billion to medical tourism, with over half of these outflows directed towards India.

As the nation contends with these daunting statistics, a surge of founders is rising to the occasion, constructing startups to bridge these cavernous gaps. Ayomide Owoyemi, a health tech expert, asserts, “More people are realizing the significance of healthcare and its role in the continent’s development. The prominence of healthcare in light of the COVID-19 pandemic has amplified its importance. Moreover, the emergence of health-tech-focused funds is also catalyzing this momentum.”

The pivotal role of healthtech companies in addressing sectoral voids surged during the pandemic, propelling innovators to craft solutions that spanned the divide. Startups such as 54Gene, LifeBank, and Helium Health surged to the forefront during this critical period, leveraging their innovation to save lives and, in turn, attract investor attention. The pandemic’s impact catalyzed the adoption of virtual healthcare solutions, underscoring the imperative of technology in healthcare delivery.

This trajectory reached a crescendo in May 2023 when Africa: The Big Deal, a platform that meticulously tracks funding deals across the continent, reported that healthtech companies emerged as the sole segment within the tech ecosystem to register positive year-on-year growth. Funding to this sector burgeoned by 7 percent, a stark contrast to fintech and energy startups that grappled with 19 percent and 5 percent decreases, respectively.

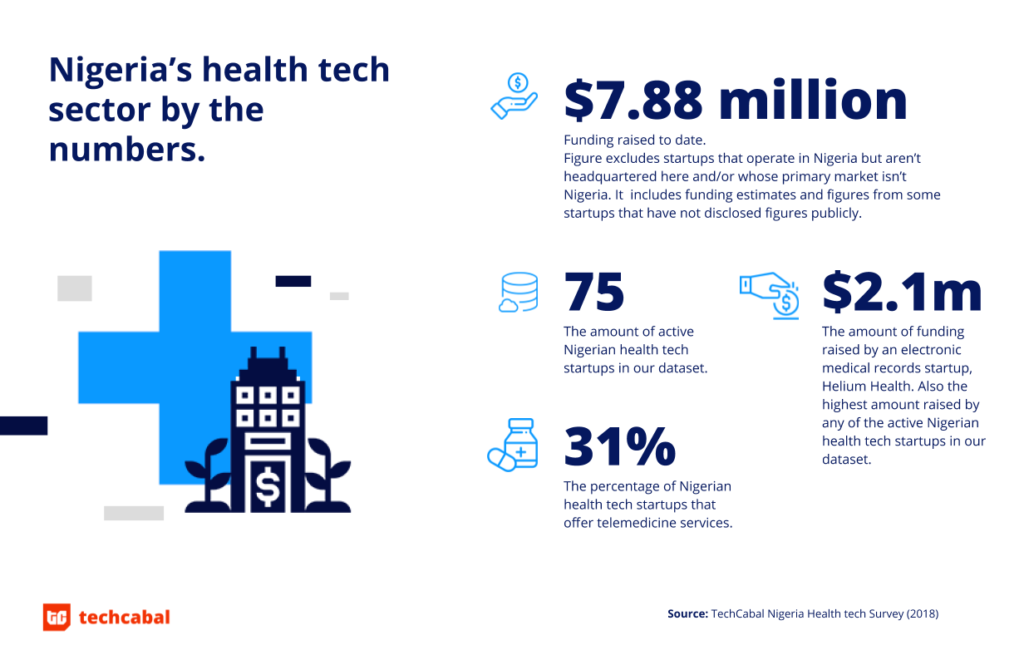

The pulsating heart of this movement resides in Nigeria, Kenya, and Egypt, with the largest funding tickets being issued to healthtech ventures like Helium Health (Nigeria, $30 million), MYDAWA (Kenya, $20 million), Yodawy (Egypt, $16 million), Remedial Health (Nigeria, $12 million), and Dawi Clinics (Egypt, $8 million).

Several other startups have also joined the funding trail, each with its unique endeavor to reshape the healthcare landscape. Among them, Berry Health (Ghana, $1.6 million), Quro Medical (South Africa, $1.3 million), DataPathology (Morocco, $1 million), Clafiya (Nigeria, $610,000), Akomah Health (Nigeria, $150,000), HealthDart (South Africa, $150,000), Talamus Health (Ghana, $150,000), and MDaaS Global (Nigeria, $150,000). The list expands further to encompass startups like Zuri Health (Kenya), TIBU Health (Kenya), and Zoei Health (South Africa), each carrying the torch of transformation within their respective niches.

Emeka Ajene, CEO of Afridigest, a platform that vigilantly tracks investment in tech companies, emphasized that a defining factor behind this trend is the maturation of certain companies. He noted the emergence of a broader spectrum of companies progressing beyond seed rounds into the next phase of growth.

This wave of investments is further buoyed by the increasing activity of specialized tech funds within the healthtech segment. Initiatives like Investing in Innovation have amplified their engagement, fostering a pan-African network that extends grants of $50,000 to 30 healthcare startups. These startups are strategically connected with international investors while receiving tailored investment readiness support.

Another dimension adding impetus to this surge is the burgeoning concept of impact investment, channeling attention toward healthcare ventures. The influx of grants, often hitherto focused on non-tech facets of healthcare, is now directed towards tech-driven healthcare delivery, amplifying the momentum.

In a recent interview, Teniola Adedeji, CEO of Pharmarun, a grant-awarded startup, shared plans for further scaling. She elaborated, “The funding we are currently seeking is geared towards scaling our product. Our ambition is to engage 1,000 pharmacists within the upcoming six to twelve months while concurrently expanding our coverage areas.”

This surge in investments reflects a burgeoning recognition of the potential inherent within the Nigerian healthtech landscape. Amidst the monumental challenges the sector faces, these investments emerge as a beacon of hope, symbolizing a collective drive to revolutionize healthcare delivery through technological innovation.